- Low probability events do occur – Anyone who has played cards or gone to a casino knows that low probability events occur. Unfortunately, we often mentally discount those probabilities too much. Duke cites Donald Trump’s presidential win as an example. Most pundits gave him a 30% chance of winning prior to the election. However, many observers misinterpreted this probability, making Trump’s victory a bigger surprise than it should have been. Still, while any single event with a low probable outcome may occur, by definition high probability events will occur more frequently. The lesson is to not bet too heavily on any single event.

- Embrace the fact that there are unknowns – Investing is about predicting the future, and the future is always unknown. Still, by our very nature, humans are often unwilling to acknowledge that we do not know something. This can lead to overconfidence in how we approach decisions and can ultimately lead to bad decisions. Utilizing a probabilistic approach to decision making tacitly acknowledges the existence that unknowns can potentially affect an outcome. This acknowledgement can lead to better decision making.

- Focus on the process not individual results – Good bets can be lost and bad bets can be won. Focusing on the results of any single bet can lead to erroneous information and ultimately bad decisions. A well-defined probabilistic process will not make every bet a winner, but will increase the likelihood of success over the long run.

- More accurate beliefs lead to better bets – If our beliefs are wrong then the probabilities underpinning our decisions will be wrong. Probabilities are based on beliefs and beliefs are based on knowledge and information. While Duke devotes a majority of her book to explaining strategies to develop more accurate beliefs, the two key points were 1) increasing knowledge and 2) developing a feedback loop to avoid bias.

- It Distinguishes Skill from Luck – This is probably the most critical element to successful manager selection and is much easier said than done. To use one of Jeremy Grantham’s most famous quotes, “90% of what passes for brilliance or incompetence in investing is the ebb and flow of investment style.” Aapryl utilizes a unique methodology that not only separates style from skill, but provides a style based framework for identifying environments in which a manager is most likely to outperform. This provides investors with insight into how much of a manager’s track record was achieved through skill and the likelihood that the skill will persist.

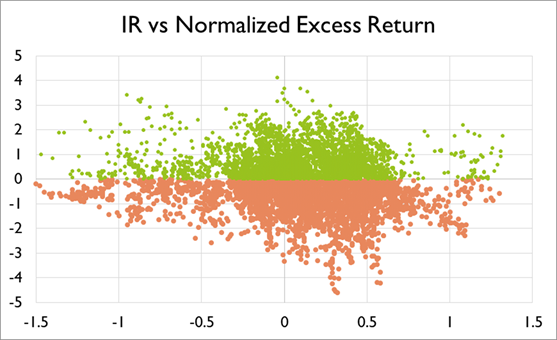

- It Focuses on Statistics that are Good Predictors rather than Statistics that are Good Outcomes – This corrects a common mistake made throughout the investment industry, which is focusing on the wrong statistics. Chart 1 below illustrates this point using Information Ratio as an example. Choosing a manager that will produce a high Information Ratio is a desirable investment outcome. Where many investors go wrong is that they look at managers’ historic Information Ratio to try to predict which managers will deliver a high Information Ratio in the future. Unfortunately, this does not work. As can be seen on the chart, the Information Ratio does not possess a lot of predictive value. While this is but one example, Aapryl’s approach is to utilize statistics that are more predictive when evaluating a manager’s track record.

Source: FIS Group

- It is Research Based– Aapryl’s methodology was developed based on years of research. The methodology has been both back-tested and put through the rigor of real-time decision making. The back-tested results show that the methodology can increase the odds of choosing managers who will be top performers. For example, Chart 2 below shows the results of some of the tests. s the chart shows, this test demonstrates that Aapryl has been extremely successful at predicting both top quintile and bottom quintile performers. This information can allow investors to screen out manager’s most likely to underperform and focus their due diligence efforts on assessing managers most likely to outperform, dramatically increasing the likelihood of choosing top managers.

Source: FIS Group

Manager selection, like poker, can be the quintessential statistical lesson. There is no correct choice, rather there are alternatives to choose from, all with uncertain outcomes. Aapryl is a platform that can help investors navigate the probabilities of those uncertain outcomes to maximize the likelihood of success.

Source: FIS Group

Manager selection, like poker, can be the quintessential statistical lesson. There is no correct choice, rather there are alternatives to choose from, all with uncertain outcomes. Aapryl is a platform that can help investors navigate the probabilities of those uncertain outcomes to maximize the likelihood of success.