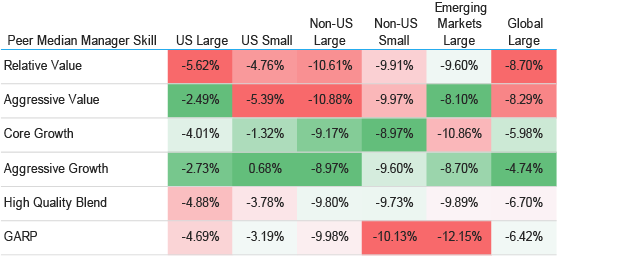

The Aapryl Quarterly Market Insight offers a lens on how active managers in general performed in various markets and sub-segments. Using Aapryl’s proprietary methodology, we measure manager skill by using the manager’s static clone (long term factor profile) as a measure of skill instead of the broad market benchmark. Manager skill is calculated by using the manager’s raw return less their static clone return.

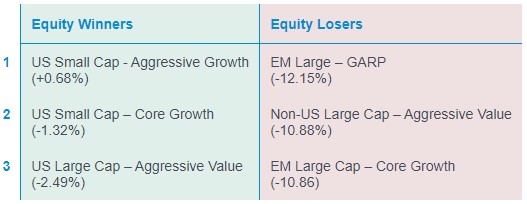

3Q2022 continued to test active equity managers. None of the median managers within Aapryl’s peer groups managed to post outperformance relative to their respective static (style) clones, except in U.S. Small Aggressive Growth (+0.68%).

Below are the top three winners and bottom three losers based on the performance of their respective peer group medians for the prior quarter:

Aapryl Peer Group Manager Skill Performance Matrix

Quarter Ending 9/30/2022

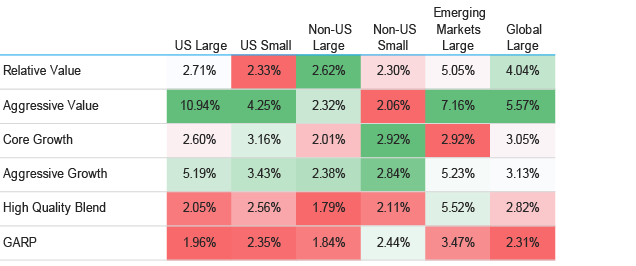

The performance spread between the top and the bottom quartile within their respective peer groups varied for each Aapryl peer group is shown below. The biggest performance spread between the peer groups top quartile vs bottom quartile occurred in the US Large Cap aggressive value peer group, with the lowest spread occurred in the Non-US Large cap high quality blend peer group for the quarter.

Top Quartile vs. Bottom Quartile

Quarter Ending 9/30/2022

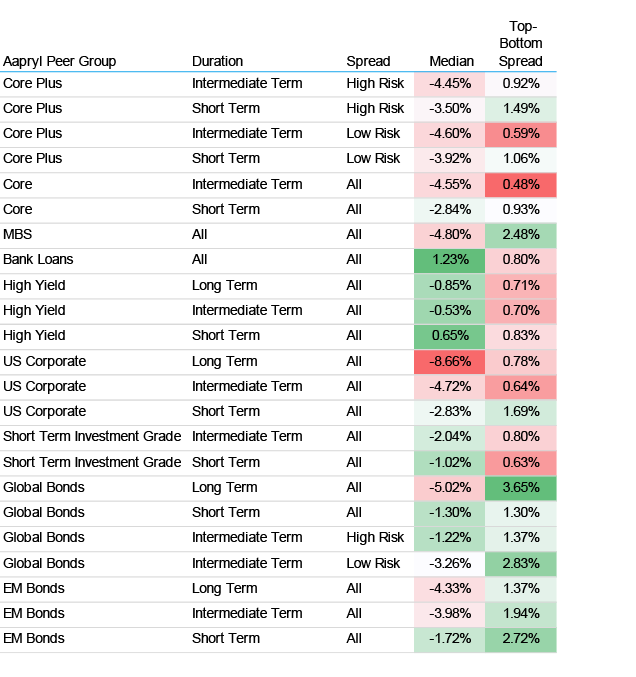

Fixed Income Manager Performance During the Quarter

Active managers in Fixed Income were not spared by the continued market turmoil. During the quarter with none of the Aapryl peer group medians able to deliver positive manager skill (manager’s raw return less static clone return). US Corporate Long-Term All Spread peer group median performed the worst (-8.66%) with Bank Loans All Duration All Spread peer group median performing the best (+1.23%). Spreads range as high as 3.65% in Global Bonds Long-term Duration All Spread and as low as 0.48% in Core Intermediate Term All Spread.