Anyone who has ever looked at a mutual fund fact sheet or an investment manager performance report has seen the phrase “past performance does not guarantee future results” posted somewhere on the page. Of course, including this disclaimer is required by virtually every regulatory authority when presenting investment performance. In reality, most of us ignore this warning. We believe that we are smarter than the average investor and that the disclaimer is government mandated language that simply does not apply to us.

What the disclaimer should remind us, however, is that performance reporting is backward looking. It is a scorecard on how an investment manager performed in the past in a similar way to how a company’s income statements explain a company’s past financial performance. There is nothing in the calculation of investment returns that predicts the future. That investors use raw performance information to predict the future maybe one of the biggest errors in the investment world as that is not what the calculation was designed to do.

Enter Aapryl. Aapryl provides various analyses that are specifically designed to forecast the future. Aapryl’s approach is to distinguish the portions of a manager’s track record that are derived from skill and can be expected to be persistent from the portions of a manager’s return that were not skill driven but derived from, dare I say, luck. Aapryl accomplishes this by incorporating several components into its calculation. The most important is a manager’s style.

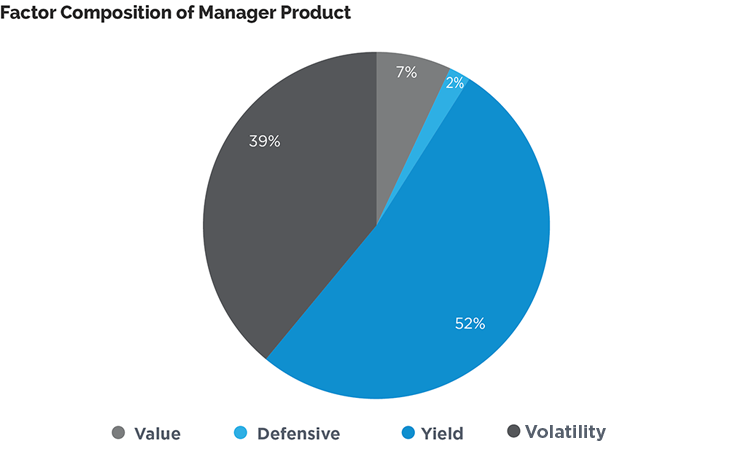

As background, style analysis is a procedure in which a portfolio’s returns are regressed against various market indices to determine a manager’s style. Within the investment management industry, style analysis typically classifies managers into a style box that distinguish value from growth managers and large-cap from small-cap managers. Aapryl’s methodology goes beyond the typical style box. Aapryl uses a set of six factors including Value, Core, Economic Sensitivity, Momentum, Yield, Defensive and Volatility to create a clone portfolio which provides a deep understanding of the drivers of a manager’s return. As can be seen on Chart 1, a manager’s clone portfolio is composed of the long-term exposure to each factor. Aapryl’s unique approach provides two major forward looking advantages when selecting managers.

Chart 1

Source: Aapryl

The first way in which Aapryl’s methodology is forward looking is through the calculation of Aapryl Expected Alpha. Aapryl’s research has shown that a manager’s over or under performance in relation to its style clone is predictable and Aapryl Expected Alpha is a calculation that makes that prediction. Put differently, Aapryl Expected Alpha can predict a manager’s alpha. Aapryl calculates a manager’s return over its style clone and then dissects and applies statistical methods to the result to identify the portion of a manager’s excess return that is most likely to persist. Using this information, Aapryl predicts the forward looking 3 year excess return. In other words, Aapryl Expected Alpha predicts which managers are most likely to add value in the future.

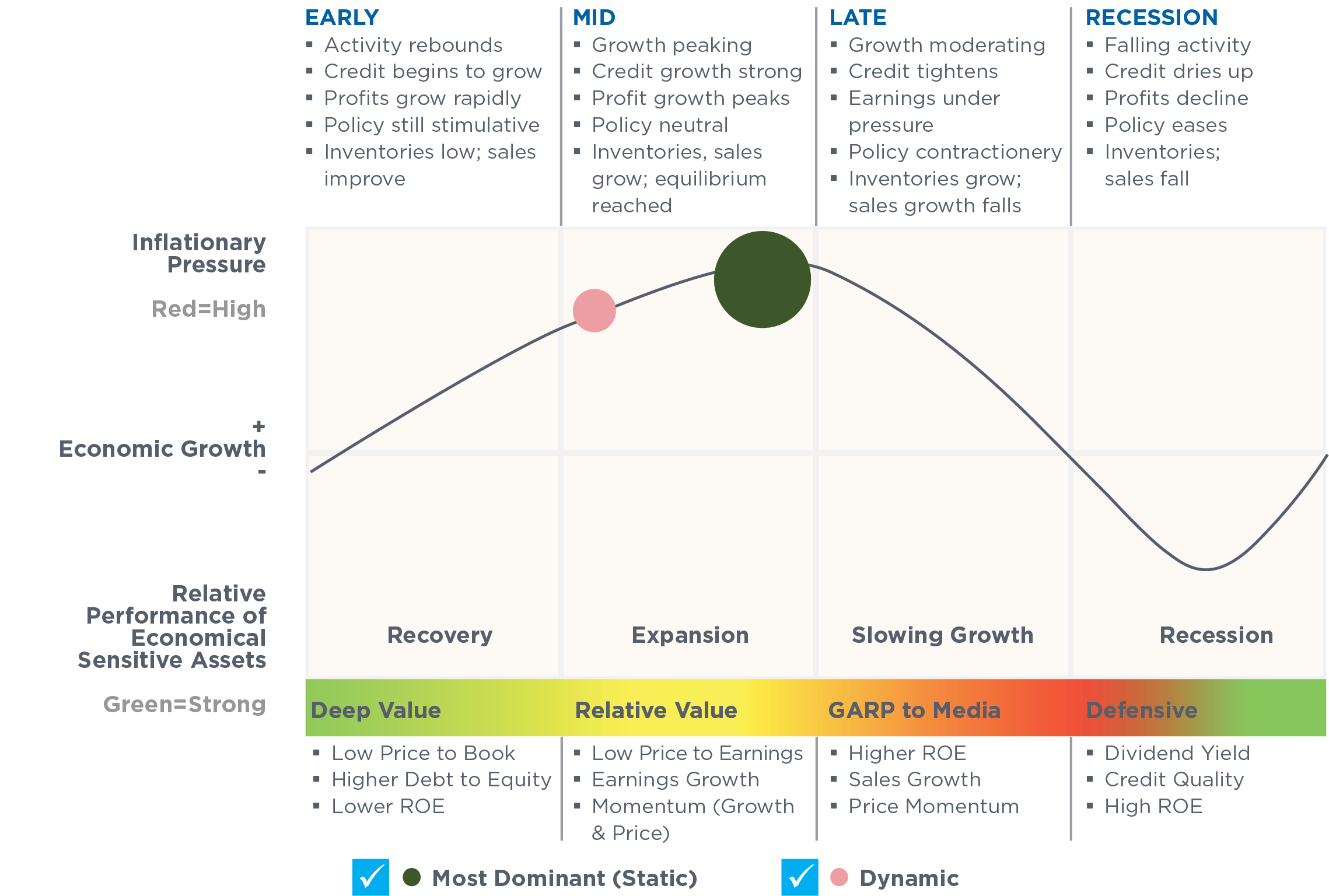

While this calculation focuses solely on the excess return or alpha portion of a manager’s return, Aapryl’s unique approach to style analysis provides a forward look into a manager’s market exposure or beta as well. The performance of the factors Aapryl uses in the analysis can be predicted based on where we are in the economic cycle. This means that the relative performance of a manager’s clone portfolio can be predicted based on the manager’s factor exposure. This is illustrated on Chart 2 below. The chart breaks the economic cycle into four distinct phases and provides information on which factors are expected to perform best in each phase of the economic cycle. The chart also shows a manager’s most dominant and second most dominant factor exposure. This provides investors with an educated guess as to the market environments in which a particular manager would be expected to perform well. For example, the manager in the chart would be expected to perform well mid-cycle based on its factor exposure.

Putting it all together, Aapryl uses style analysis and other statistical methods to help investors fully understand what can reasonably be expected from a manager in the future. It provides a glimpse into future alpha through the Aapryl Expected Alpha which predicts a manager’s future excess return. It also provides insight into the market environments in which different managers should perform best. Both are invaluable for manager selection and all of the calculations are performed using past return data. So while past performance may not guarantee future results, Aapryl users have a big advantage in understanding what can be learned from past performance and in picking managers that can be expected to perform best in the future.